A trust is a legal arrangement in which a person, known as the grantor or settlor, transfers assets to a trustee to hold and manage for the benefit of one or more beneficiaries. The trustee has a fiduciary duty to manage the trust assets in the best interest of the beneficiaries and according to the terms of the trust document. Trusts can be used for a variety of purposes, including estate planning, asset protection, and charitable giving.

There are several key parties involved in a trust. The grantor is the person who creates the trust and transfers assets into it. The trustee is responsible for managing the trust assets and distributing income and principal to the beneficiaries according to the terms of the trust. The beneficiaries are the individuals or organizations that will benefit from the trust. It’s important to note that a trust is a separate legal entity from the grantor, trustee, and beneficiaries, and it can own assets, enter into contracts, and file tax returns.

Trusts can be revocable or irrevocable. A revocable trust allows the grantor to retain control over the trust assets and make changes to the trust or even revoke it entirely. An irrevocable trust, on the other hand, cannot be changed or revoked once it is created, although there are some exceptions depending on state law. Each type of trust has its own advantages and disadvantages, so it’s important to carefully consider your goals and circumstances when choosing the right type of trust for your needs.

Key Takeaways

- Trusts are legal arrangements that allow a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.

- There are different types of trusts, including revocable and irrevocable trusts, and each has its own advantages and disadvantages.

- Trustees are responsible for managing the trust and its assets, while beneficiaries are the individuals who will benefit from the trust.

- The trust document is a legal document that outlines the terms and conditions of the trust, including the rights and responsibilities of the trustee and beneficiaries.

- Transferring assets into the trust involves changing the ownership of the assets from the individual to the trust, which may require legal and financial assistance.

Choosing the Right Type of Trust

When it comes to choosing the right type of trust, there are several options to consider based on your specific goals and circumstances. One common type of trust is a revocable living trust, which allows the grantor to retain control over the trust assets during their lifetime and avoid probate upon their death. This type of trust can be a useful tool for managing assets and providing for loved ones after the grantor’s passing.

Another option is an irrevocable trust, which can provide asset protection and estate tax benefits. Assets transferred into an irrevocable trust are generally shielded from creditors and may also be excluded from the grantor’s taxable estate, reducing potential estate tax liability. However, it’s important to note that once assets are transferred into an irrevocable trust, they cannot be taken back by the grantor.

For those interested in charitable giving, a charitable remainder trust or charitable lead trust may be a good option. These types of trusts allow the grantor to make a charitable contribution while also providing income for themselves or their beneficiaries. Charitable trusts can offer tax benefits and support philanthropic causes that are important to the grantor.

Special needs trusts are designed to provide for individuals with disabilities without jeopardizing their eligibility for government benefits such as Medicaid and Supplemental Security Income. These trusts can be an important tool for families with special needs individuals who want to ensure their loved one’s financial security while preserving their access to essential government assistance.

Identifying and Selecting Trustees and Beneficiaries

Selecting the right trustee is a crucial decision when creating a trust. The trustee is responsible for managing the trust assets and carrying out the terms of the trust document, so it’s important to choose someone who is trustworthy, financially responsible, and capable of fulfilling their fiduciary duties. Many people choose a family member or close friend as trustee, while others opt for a professional trustee such as a bank or trust company.

When selecting beneficiaries for a trust, it’s important to consider their needs and circumstances. Beneficiaries can be individuals, such as children or grandchildren, or organizations, such as charities or educational institutions. It’s important to clearly define the beneficiaries of the trust and specify how and when they will receive distributions from the trust. This can help ensure that the trust assets are used in accordance with the grantor’s wishes and provide for the long-term financial security of the beneficiaries.

In some cases, it may be appropriate to name contingent beneficiaries who will receive trust assets if the primary beneficiaries are unable to do so. This can provide added flexibility and protection in case of unforeseen events such as the death or incapacity of a primary beneficiary. Careful consideration should be given to selecting both primary and contingent beneficiaries to ensure that the trust serves its intended purpose and provides for the needs of all involved parties.

Drafting the Trust Document

| Trust Document Drafting Metrics | 2019 | 2020 | 2021 |

|---|---|---|---|

| Number of Trust Documents Drafted | 150 | 175 | 200 |

| Average Time to Draft a Trust Document (in hours) | 10 | 9 | 8 |

| Client Satisfaction Rate | 85% | 90% | 92% |

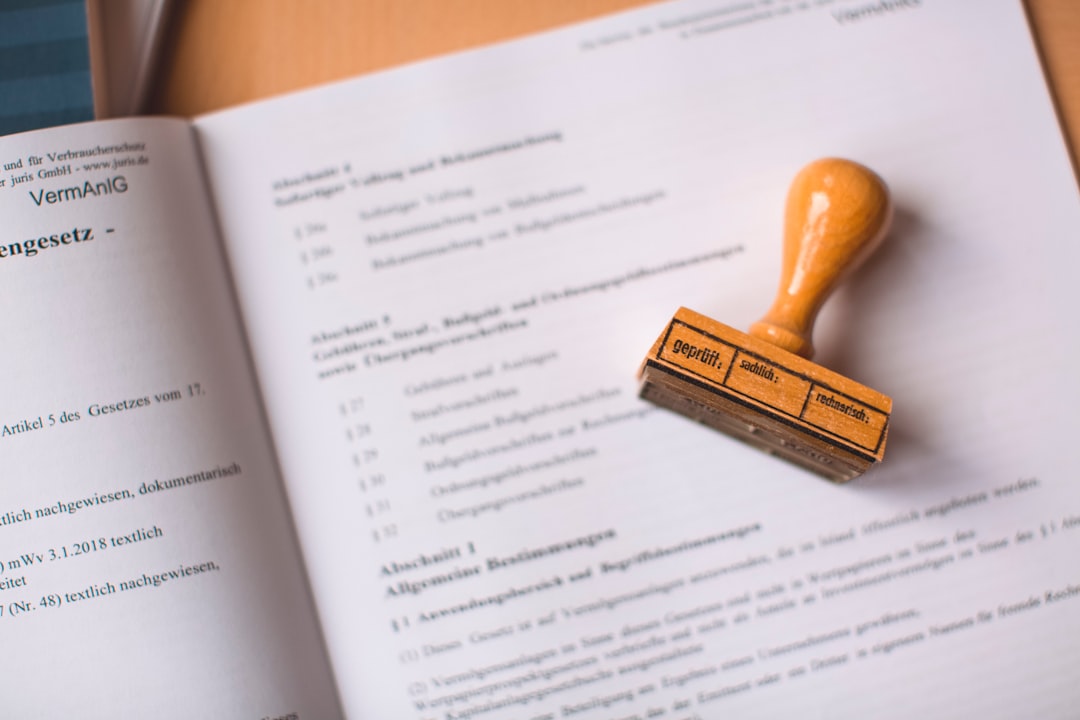

The trust document is a legal instrument that outlines the terms and conditions of the trust, including the powers and duties of the trustee, the rights of the beneficiaries, and the distribution of trust assets. It’s important to work with an experienced attorney to draft a comprehensive and legally sound trust document that reflects your wishes and complies with applicable laws.

The trust document should clearly specify the purpose of the trust, the identity of the grantor, trustee, and beneficiaries, and the assets that are being transferred into the trust. It should also outline how the trust assets will be managed and distributed, including any conditions or restrictions on distributions. Additionally, the document should address how any income or expenses related to the trust will be handled and provide instructions for how the trust should be administered in various scenarios.

In addition to these fundamental provisions, the trust document may also include specific instructions for managing certain types of assets, such as real estate or business interests, as well as provisions for addressing potential changes in circumstances, such as divorce or incapacity. The document should be carefully reviewed and updated as needed to ensure that it accurately reflects your intentions and remains effective in achieving your goals.

Transferring Assets into the Trust

Once the trust document has been drafted and executed, it’s necessary to transfer assets into the trust in order to fund it. This typically involves re-titling assets such as real estate, bank accounts, investment accounts, and other property in the name of the trust. It’s important to follow proper procedures for transferring each type of asset into the trust to ensure that it is legally effective and fully accomplishes your intentions.

Real estate can be transferred into a trust by executing a new deed that names the trustee as the owner of the property. Bank accounts and investment accounts can be retitled in the name of the trust by working with your financial institution to update account ownership records. Other types of property, such as vehicles or valuable personal belongings, may require specific documentation or procedures to transfer ownership into the trust.

It’s important to keep thorough records of all asset transfers into the trust and update beneficiary designations on any accounts or policies that are not transferred into the trust. This can help ensure that all of your assets are properly coordinated with your estate plan and will be distributed according to your wishes in case of incapacity or death.

Managing and Administering the Trust

Once a trust has been established and funded, it requires ongoing management and administration to ensure that it continues to serve its intended purpose. The trustee is responsible for managing the trust assets, making distributions to beneficiaries, filing tax returns, and fulfilling other administrative duties according to the terms of the trust document and applicable laws.

Trust administration involves keeping accurate records of all income, expenses, and distributions related to the trust, as well as providing regular reports to beneficiaries about the status of the trust. The trustee must also invest and manage trust assets prudently, considering factors such as risk tolerance, liquidity needs, and long-term growth objectives.

In addition to these financial responsibilities, trustees must also adhere to legal requirements such as filing tax returns for the trust and complying with any applicable state laws governing trusts. It’s important for trustees to seek professional advice from attorneys, accountants, and financial advisors as needed to ensure that they fulfill their duties effectively and in compliance with all legal requirements.

Understanding Legal and Tax Implications

Trusts have important legal and tax implications that should be carefully considered when creating and administering them. Depending on factors such as the type of trust, its purpose, and its funding sources, there may be various legal requirements that must be met in order for the trust to be valid and effective.

Additionally, trusts can have significant tax implications for both grantors and beneficiaries. Income generated by a trust is generally subject to income tax at either the individual or trust level depending on how it is distributed. Trusts may also be subject to estate tax if their value exceeds certain thresholds at the time of transfer or upon termination.

It’s important for grantors and trustees to work with experienced professionals such as attorneys, accountants, and financial advisors who can provide guidance on navigating these legal and tax considerations effectively. By understanding these implications upfront and planning accordingly, you can ensure that your trusts are structured in a way that maximizes their benefits while minimizing potential drawbacks.

In conclusion, trusts are versatile legal instruments that can serve a wide range of purposes in estate planning, asset protection, charitable giving, and more. By understanding their basics, choosing the right type of trust, identifying suitable trustees and beneficiaries, drafting comprehensive documents, transferring assets effectively, managing trusts prudently, and understanding their legal and tax implications thoroughly, individuals can create trusts that effectively achieve their goals while complying with all applicable laws. Working with experienced professionals throughout this process can help ensure that trusts are structured effectively and administered properly for maximum benefit to all involved parties.

If you’re interested in setting up a trust without an attorney, you may want to check out the article “The Pros and Cons of DIY Trusts” on creativesroyal.com. This article discusses the potential benefits and drawbacks of creating a trust without legal assistance, providing valuable insights for anyone considering this option.

FAQs

What is a trust?

A trust is a legal arrangement in which a person (the trustor) gives control of their assets to a trustee, who manages the assets for the benefit of another person or group of people (the beneficiaries).

Can you set up a trust without an attorney?

Yes, it is possible to set up a trust without an attorney. However, it is important to carefully consider the legal and financial implications of creating a trust without professional guidance.

What are the potential risks of setting up a trust without an attorney?

Setting up a trust without an attorney can lead to errors in the legal documentation, which may result in the trust not being legally valid or not achieving the intended goals. Additionally, without legal advice, the trustor may not fully understand the tax and financial implications of the trust.

What are the benefits of using an attorney to set up a trust?

An attorney can provide legal expertise and guidance to ensure that the trust is properly structured and documented. They can also help the trustor understand the potential tax implications and ensure that the trust aligns with their overall estate planning goals.

What are the steps involved in setting up a trust with an attorney?

The steps involved in setting up a trust with an attorney typically include discussing the trustor’s goals and wishes, drafting the trust document, transferring assets into the trust, and ensuring that the trust is properly funded and administered according to the trustor’s wishes.